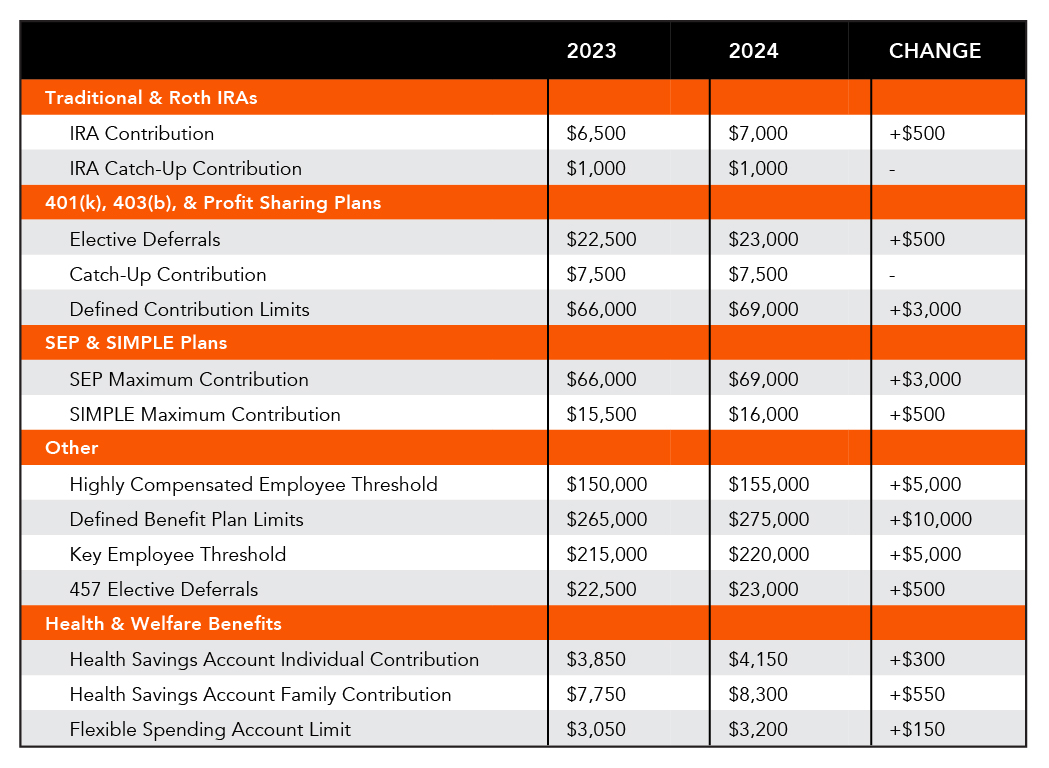

Simple Plan Contributions 2025. You can contribute a maximum of $7,000 (up from $6,500 for 2025). In 2025, employees can contribute $16,000 into their simple ira, which is up from the 2025 simple ira limit of.

For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to a maximum of the lesser of up to 10% of. Simple iras and simplified employee pension plans (seps) can allow employees to treat contributions as nondeductible roth contributions under act section.

The deadline for most individuals to make an ira regular contribution for 2025 was april 18, 2025, and contributions made from january 1, 2025,.

Simple Irs Contribution Limits 2025 Dore Nancey, However, beginning in 2025, secure 2.0 permits an employer to switch from a simple ira to a safe harbor 401(k) plan in the middle of a year, provided that. On january 8, 2025, the irs released a notice describing many changes required to implement the secure act 2.0.

2025 Essential Plan Limits Fred Pamela, Simple ira contribution limits for 2025. Simple iras and simplified employee pension plans (seps) can allow employees to treat contributions as nondeductible roth contributions under act section.

Maximum Defined Contribution 2025 Sandy Cornelia, If you are 50 or above and your simple ira plan allows,. However, beginning in 2025, secure 2.0 permits an employer to switch from a simple ira to a safe harbor 401(k) plan in the middle of a year, provided that.

What’s New for Retirement Saving for 2025? SEIA Signature Estate, The maximum contribution limit for roth and traditional iras for 2025 is: This amount has slightly increased from the 2025 simple ira contribution limit of $15,500.

Unlock Your Financial Future A Quick Guide to 2025's IRA and, The simple ira contribution limit for 2025 is $16,000. For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to a maximum of the lesser of up to 10% of.

2025 Contribution Limits Announced by the IRS, $7,000 if you're younger than age 50. Secure 2.0 changed retirement planning for small businesses and their employees.

Plan Sponsor Update 2025 Retirement & Employee Benefit Plan Limits, The annual limit for simples and simple iras will also remain at $3,500. $8,000 if you're age 50 or older.

2025 Max Employee 401k Contribution Cari Marsha, The annual limit for simples and simple iras will also remain at $3,500. On january 8, 2025, the irs released a notice describing many changes required to implement the secure act 2.0.

Able Contribution Limits 2025 Jada Rhonda, So what happens when an employee walks in on january 3, 2025, and asks to start making roth contributions to their simple ira? You can contribute a maximum of $7,000 (up from $6,500 for 2025).

How SEP, SIMPLE, and OwnerOnly 401(k) Plans Stack Up — Ascensus, The simple ira contribution limit for 2025 is $16,000. The maximum contribution limit for roth and traditional iras for 2025 is:

The simple ira and simple 401 (k) contribution limits will increase from $15,500 in 2025 to $16,000 in 2025.